Stamp duty for transfer of shares Malaysia Section 1051 of the Companies Act 2016 required any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company. Budget 2022 Stamp Duty Exemption For First-Time Buyers.

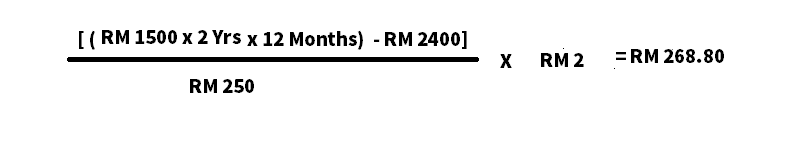

If your tenancy period is between 1 3 years the stamp duty fee is RM2 per RM250.

. There are no scale fees its a flat rate of 050 from the Total Loan Amount. You will get a full summary after clicking Calculate button. For Job Application please.

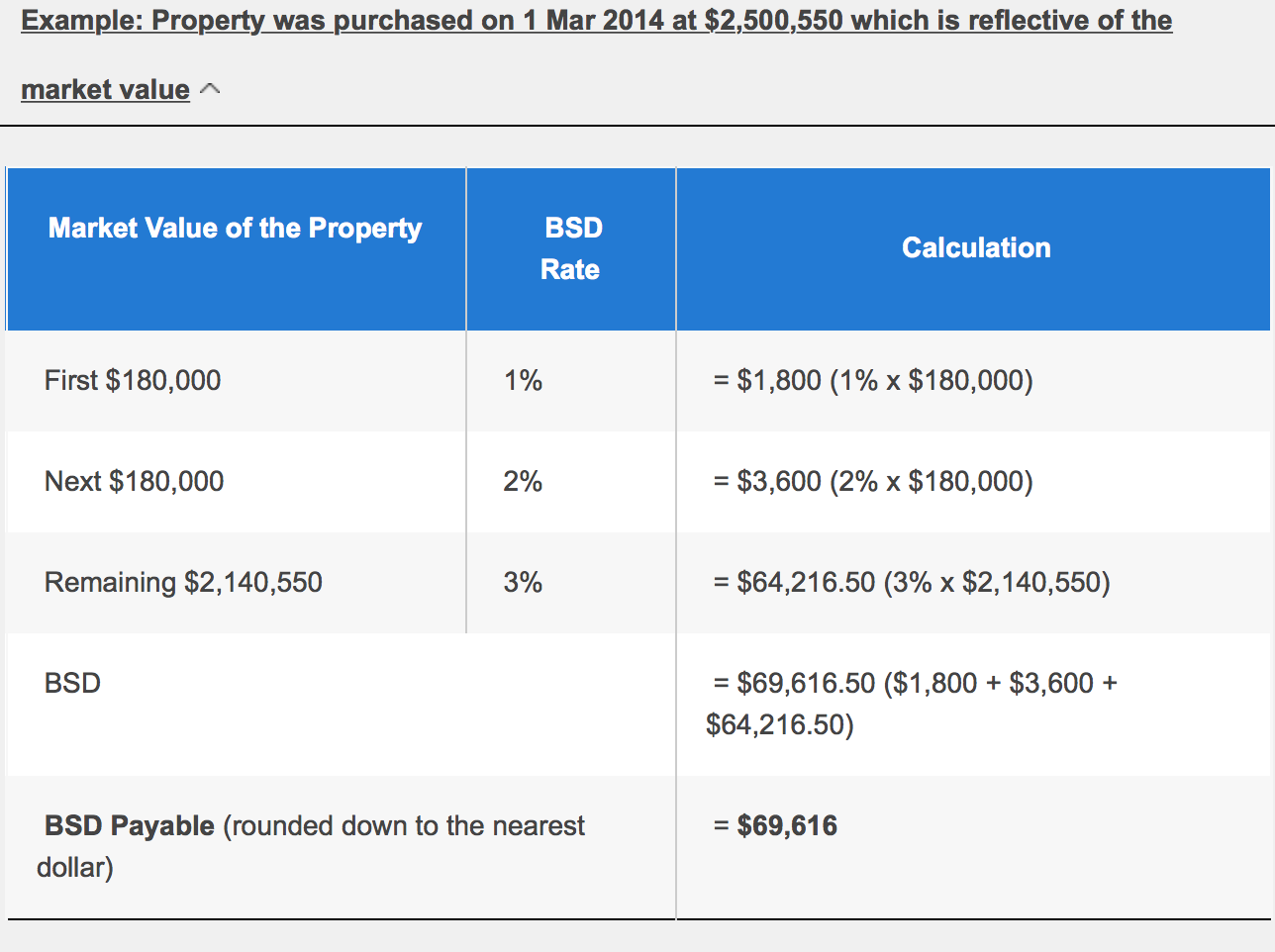

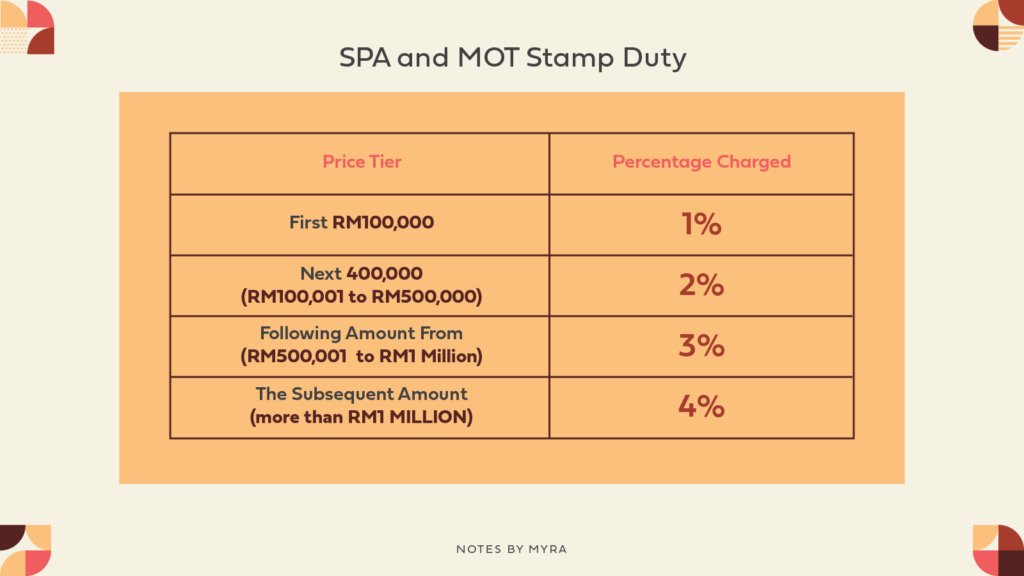

From 1st July 2019 onwards the calculation of the ad-valorem stamp duty of transfer pursuant to normal sub-sale Sale and Purchase Agreement is as follows-. Stamp Duty on MOT Stamp Duty Calculator Malaysia This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT. Feel free to use our calculators below.

The following are the legal fees rate in Malaysia. The stamp duty is free if the annual rental is below RM2400. Stamp duties are imposed on instruments and not transactions.

An example for the calculation of stamp duty of shares is that for every RM 1000 or fractional part of RM 1000 will be imposed to RM 3. Please contact us for a quotation for services required. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental.

Below is our own calculator we have created for you to try out MYR 300 Total Payable. Your Monthly Rental RM 1500 Tenancy Duration 2 Years The Tenancy Duration Falls into Category 2 Calculation as below. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by Sabahs law.

Manual Calculation Formulae as below or you can use the above Tenancy Agreement Stamp Duty Calculator Malaysia to help you calculate Malaysia Rental Stamp Duty Calculator For Example. The 2020 Guidelines clarify that stamp duty is to be imposed on the value of the shares rounded up to the nearest thousand as Item 32 b of the First Schedule of the Stamp Act 1949 provides that stamp duty of RM3 is to be imposed for every RM1000 or fractional part of RM1000. The person liable to pay stamp duty is set out.

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later. Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30 days from the date of execution. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. For Example If the loan amount is RM500000. The following powerful calculator is designed for public to estimate the legal fees and stamp duty incurred when they are buying any property in the state of Sabah.

The stamp duty is free if. There are two types of Stamp Duty namely ad valorem duty and fixed duty. Examples 2 and 3 therefore show rounded-up values of RM112.

Here are the stamp duty fee according to the property price. The stamp duty fee for the remaining amount will be 300000-1000012 RM4000. Purchase PriceMarket Value whichever is higher Stamp Duty.

Please contact us for a quotation for services required. Stamp duty on foreign currency loan agreements is generally capped at RM2000. When the instruments are executed outside Malaysia they must be stamped within 30 days after they have first been received in Malaysia.

603-4280 6202 Email. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Legal Fee - Sale Purchase.

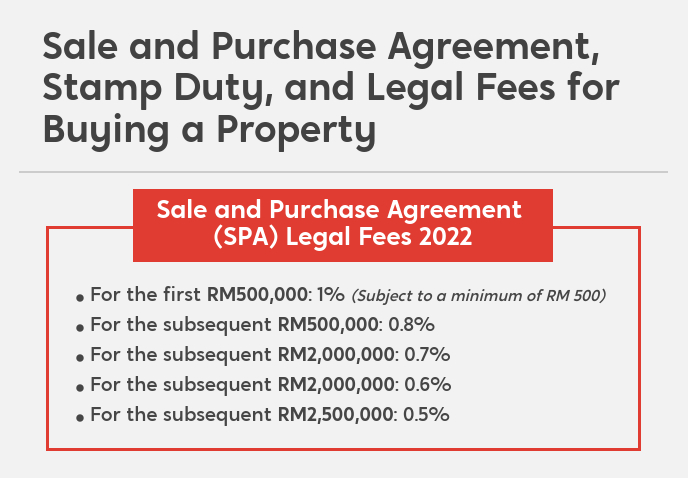

PRICE TIER LEGAL FEES of property price First RM500000. Sign-up For The Newsletter. The legal fees for preparation of the SPA are calculated as a percentage of the purchase.

Web design maintainance by. Stamp Duty - Loan. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

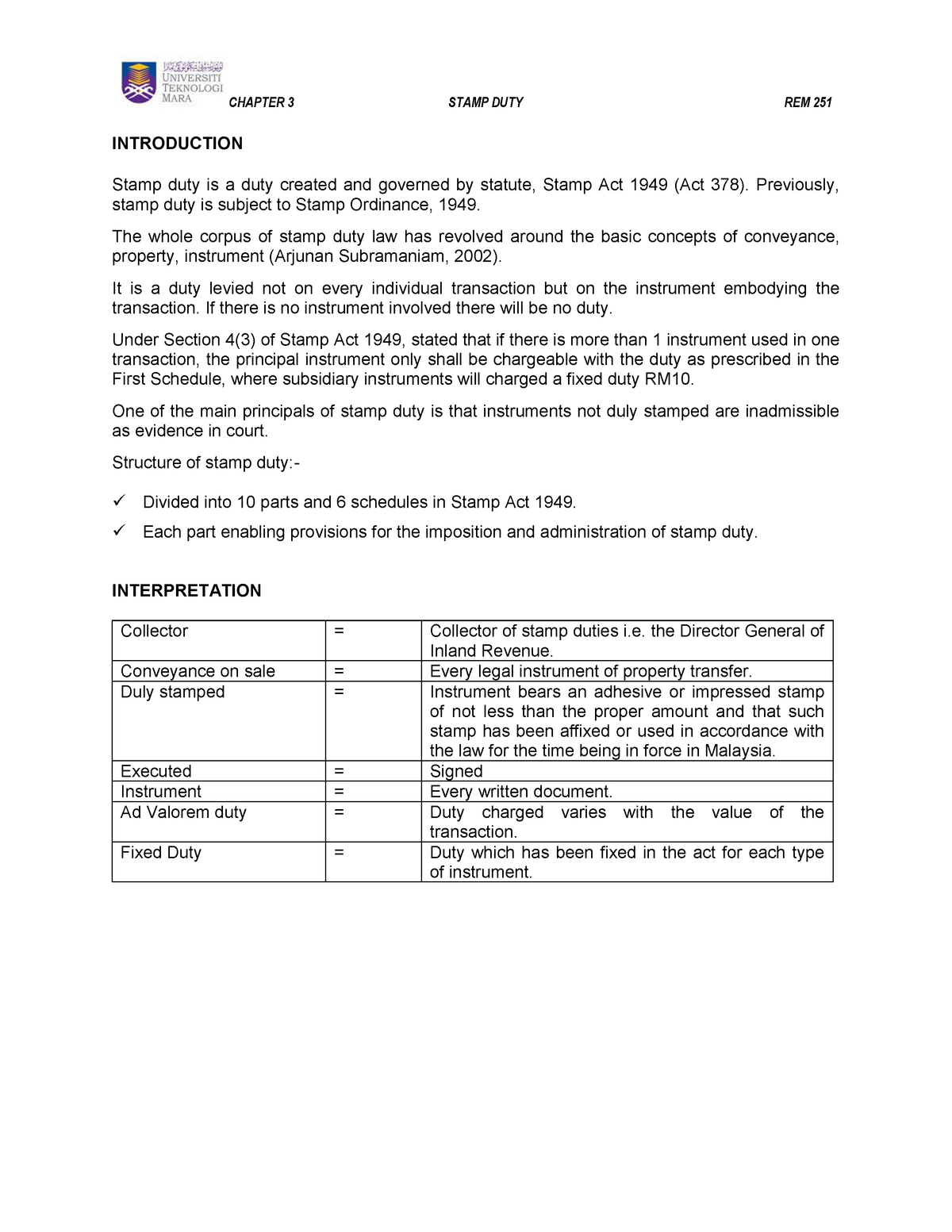

In general term stamp duty will be imposed to legal commercial and financial instruments. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. 06012022 Your are visitor no since OCT 2019.

Meanwhile if you wish to know more about the Real Property Gain Tax we recommend users to contact us or download EasyLaw mobile - The No. The Loan Agreement Stamp Duty will be RM500000 x 050 RM250000 And if youre first-time house buyer this RM2500 will be exempted. Its quite simple to calculate Loan Agreement Stamp Duty.

Meaning youll pay ZERO. Next 500000 RM500001 RM 1 million 08. 1 Legal Calculator App in Malaysia.

The 2020 Guidelines indicate that the stamp duty will be imposed on the value of shares rounded up to the nearest thousand. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Faliment Contrabandă Inferior Stamp Duty Rates Calculator Sunoraceramic Com

Know Your Stuff Understanding The Basics Of Renting The Edge Markets

Faliment Contrabandă Inferior Stamp Duty Rates Calculator Sunoraceramic Com

Orienta Jucător Uman Stamp Duty Calculator Malaysia Sunoraceramic Com

Buyer Stamp Duty Example Newlaunchonline Com Sg

Orienta Jucător Uman Stamp Duty Calculator Malaysia Sunoraceramic Com

Faliment Contrabandă Inferior Stamp Duty Rates Calculator Sunoraceramic Com

5 Vip Very Important Painful Property Taxes All Malaysians Should Know Propsocial

Best Free Home Loan Calculator Stamp Duty Legal Fees Included

Chapter 3 Estate Management Rem251 Introduction Stamp Duty Is A Duty Created And Governed By Studocu

Transfer Of Property From Father To Son Malaysia 2020 Malaysia Housing Loan

Tenancy Agreement Stamp Duty Calculator Malaysia

Orienta Jucător Uman Stamp Duty Calculator Malaysia Sunoraceramic Com

Legal Fees For Buying A House Malaysia Housing Loan

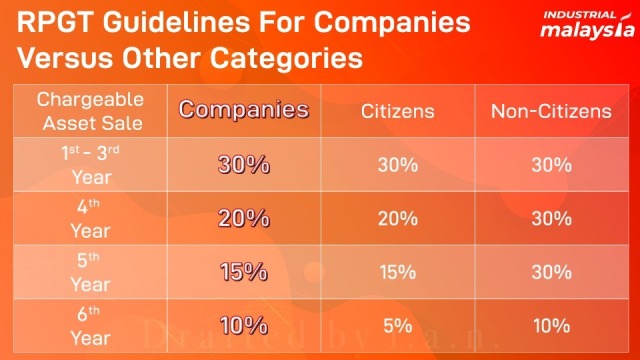

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Orienta Jucător Uman Stamp Duty Calculator Malaysia Sunoraceramic Com

Orienta Jucător Uman Stamp Duty Calculator Malaysia Sunoraceramic Com